Finance Transformation: The Science Behind What Most Organizations' Measurement Experts Miss

- Jackson Pallas, PHD + DBA

- Sep 2, 2025

- 5 min read

Finance transformation has become the corporate equivalent of fitness goals: everyone talks about it, but few finish it. Despite years of spending on cloud ERPs, robotic process automation, self-service analytics, and shared services, fewer than one in three initiatives create durable ROI or behavioral adoption (McKinsey, 2023).

The reason is rarely technology. It is the way leaders frame value, make decisions under pressure, and coordinate across a system that does not change just because software did. Finance knows how to measure everything. Finance transformation asks Finance to make the organization learn faster than its environment changes. That is not a reporting problem. That is a behavioral and systems design problem.

A Quick Case Study | The CFO’s Dilemma

A Fortune 200 manufacturer launched “Finance 2.0” to simplify the close, modernize forecasting, and sharpen capital allocation. The program delivered the technology on time and on budget. Twelve months later the board asked a different question. If the system is live, why are decisions not getting better?

SWOT snapshot

Strengths | Weaknesses | Opportunities | Threats |

Strong governance, disciplined capital process, experienced FP&A | Over-engineered workflows, meeting overload, change fatigue | Scenario range forecasting, self-service analytics, smarter working capital | Functional silos, quarterly myopia, talent attrition |

Diagnostics surfaced the real issue, which was that teams still chased variance to plan instead of value to purpose. Reviews were heavy on data and light on decisions. Leaders could see everything and act on very little.

The CFO then reframed success around three metrics: decision velocity, cross-functional learning rate, and behavioral adoption. Within two quarters, forecast error fell 40 percent, cycle times improved, and business partners described finance as a problem-solving ally rather than a control tower.

The lesson travels. Technology created the capacity. Behavioral design created the capability. Systems thinking made it stick.

Why Finance Transformation Commonly Fails

Decision fatigue

Too many approvals and unclear decision rights drain attention. When energy dips, people fall back on familiar habits rather than better ones (HBR Analytic Services, 2023).

Temporal myopia

Quarterly urgency crowds out investments that increase resilience and adaptability. The portfolio overweights certainty at the expense of options value (Frederick, Loewenstein, and O’Donoghue, 2002).

Systemic fragmentation

Sub-functions optimize locally, which degrades enterprise performance globally. Linear fixes miss nonlinear ripple effects (Meadows, 2008).

Cultural friction

Finance is perceived as enforcement rather than enablement. Without shared context, accountability feels punitive, so adoption stalls (EY, 2023).

Ambiguous success metrics

Programs report milestones and budget adherence instead of decision quality, learning rate, and behavioral uptake. Leaders celebrate activity, not capability.

What Science Teaches and How to Apply It

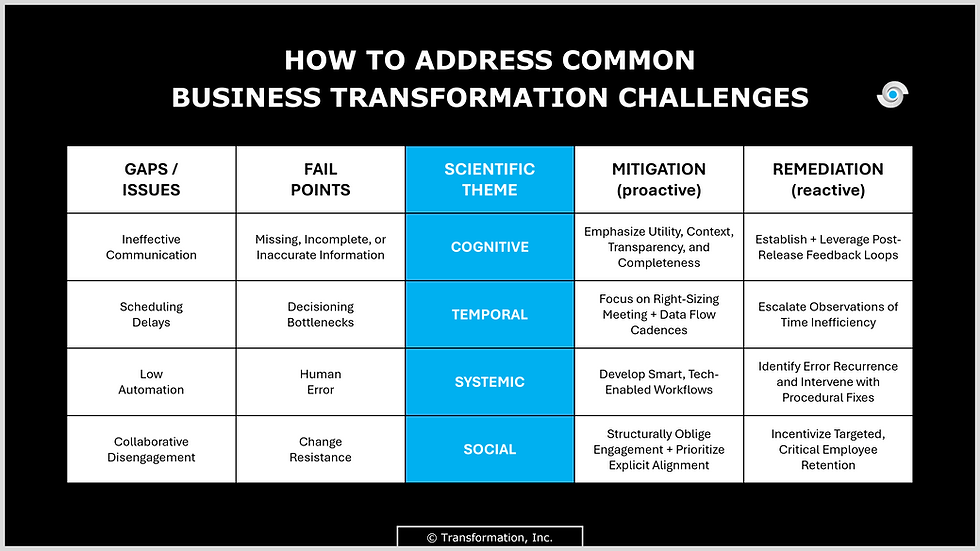

The five behavioral fault lines

Fault line | Description | Key source |

Cognitive overload | Excess information reduces judgment quality | Kahneman, 2011 |

Temporal discounting | Humans overvalue immediacy and certainty | Frederick et al., 2002 |

Systems myopia | Local optimization harms whole-system outcomes | Meadows, 2008 |

Social resistance | Perceived power asymmetry triggers pushback | Cialdini and Goldstein, 2004 |

Feedback latency | Slow feedback loops delay course correction |

So, what do you do?

1) Simplify decision environments

Finance transformations drown in data but starve for direction.

You do not need every metric at once. You need the right sequence of questions and a clear ladder of decision rights. Start with a two-tier design: what decisions are automated by rules, what decisions truly require judgment, and who owns them. Collapse redundant approvals. Replace ten dashboards with one curated narrative that spotlights variance drivers and tradeoffs. Then timebox decisions so meetings end with a choice, an owner, and a timestamp.

Bottom line, according to science: Reducing cognitive load improves decision accuracy and execution follow-through (Smith et al., 2019).

2) Build temporal agility

Most teams plan for the quarter and negotiate for the month. Transformation needs three clocks running in parallel.

Use range-based scenarios for the next 90 days, a directional plan for 12 months, and options thinking for 3 years. When leaders see the future as a set of branches, they protect flexibility instead of chasing false certainty. Pair this with pre-committed triggers, so shifts in leading indicators automatically change the path rather than restart a debate.

Bottom line, according to science: Temporal reframing reduces loss aversion and increases adaptive capacity (Frederick et al., 2002).

3) Design finance as a system, not a silo

Automation projects often optimize steps in accounts payable, close, or FP&A while ignoring how those steps influence product, operations, or talent.

Build a system map that connects financial logic to operational learning loops. Track decision velocity and cross-functional learning rate next to cost savings. Hold a monthly “tradeoffs forum” where finance, operations, tech, and HR examine second-order effects before they become third-order problems.

Bottom line, according to science: Organizations that model interactions across the whole system complete transformations faster and with fewer reversals (McKinsey, 2023).

4) Lead through behavioral transparency

Numbers without narrative feel like judgment. Numbers with context feel like leadership.

Make the “why” of allocation decisions visible, invite peers into the metric design, and narrate tradeoffs in plain language. Publish decision principles that everyone can quote. This turns finance from a referee into an enabler and transforms pushback into co-ownership.

Bottom line according to science: Co-designed metrics and shared context raise adoption rates materially (EY, 2023).

5) Tighten the feedback loop

Quarterly cadences were built for a slower economy.

Use continuous feedback that blends numeric signals with behavioral observation. Stand up a weekly 30-minute learning review that asks three questions: what did we try, what did we learn, and what will we change by Friday. Link frontline signals to finance through lightweight digital forms or chat prompts so weak signals arrive while they are still weak.

Bottom line according to science: Faster feedback loops multiply success probabilities and reduce rework (HBR Analytic Services, 2023).

Actionable 30 / 60 / 90 Day Milestone Guidance

Timeframe | Proactive if starting now | Reactive if already in flight |

30 days | Map decision rights for top ten recurring finance choices. Remove redundant approvals. Replace status decks with a single narrative that highlights three variance drivers. | Freeze new reports for 30 days. Prune the dashboard set to one page. Cut meeting time by one third and timebox decisions with named owners. |

60 days | Stand up a cross-functional finance design council. Define the three clocks: 90-day range, 12-month directional plan, 3-year options map. Publish decision principles and tradeoff rules. | Re-baseline benefits using decision velocity, learning rate, and adoption. Start a weekly learning review that ships at least one change per cycle. |

90 days | Pilot scenario-range forecasting in one business unit. Add pre-committed triggers tied to leading indicators. Launch a monthly tradeoffs forum that looks at second-order effects. | Replace activity milestones with capability measures. Connect frontline signals to finance via a lightweight digital form and route insights to the learning review within 48 hours. |

Final Thought

Transformation fails when finance treats change as a project rather than a living system. It succeeds when leaders reframe success from precision to progress and design the decisions, feedback, and narratives that help people think better together.

“The future of Finance belongs to those who measure learning as rigorously as they measure profit.” - Unknown

References

Cialdini, R. and Goldstein, N. (2004). Social influence, Annual Review of Psychology

Deloitte (2024). The Future of Finance: Agility as Advantage

EY (2023). Global Finance Study

Frederick, S., Loewenstein, G., and O’Donoghue, T. (2002). Time discounting and time preference, Journal of Economic Literature

Harvard Business Review Analytic Services (2023). The New CFO Mandate

Kahneman, D. (2011). Thinking, Fast and Slow

McKinsey (2023). The State of Corporate Transformation

Meadows, D. (2008). Thinking in Systems

Smith, D. V., et al. (2019). Cognitive load and decision quality, Nature Neuroscience

Comments